What a Difference a Year Makes

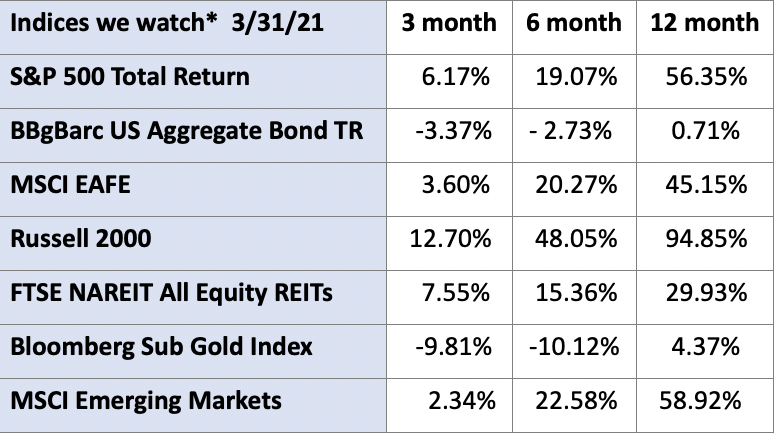

The end of this quarter marked a full year since the Coronavirus outbreak. For the past year we had to change our daily routines in ways we could have never imagined. We won’t list the litany of ways in which our lives were impacted – (we have all lived it!) – but it resulted in a tumultuous year of ups and downs for the various global markets. Out of curiosity, we looked back to see where we were last year at this time and what we were thinking. We also compared the index returns for the same time frame. Last March 31, the broad market indices were all down double digits for the first quarter, except for the Gold index and the Bonds indices. As the chart above indicates, what a difference a year makes!

As we reviewed Bryant & Brannock’s commentary from last year, we were reminded of the feelings of uncertainty we had. The commentary for first quarter 2020 was, in fact, titled ‘The Certainty of Uncertainty’. At that time, the experts varied greatly in their predictions. The worst was already behind us, some speculated, while others expected it would last a few more weeks, maybe even months. One thing is for certain, if we had known then that we would still be in a state of sporadic global lockdowns a year later, we would have been amazed to see how well the markets ended up. Fear and uncertainty could have easily persuaded an investor to pull out of the market. Instead, the past year proved to be a testament to trusting in an appropriately diversified asset allocation to help mitigate risk while staying invested for the long run.

How did we have such relative prosperity in the midst of so much turmoil? There are many reasons. For one, central banks around the world took dramatic actions to provide short term monetary relief and assured us that they would continue to do so. Global pharmaceutical companies engineered vaccines to combat the virus much more quickly than would have normally occurred, which offered hope that the spread could be contained. Technology allowed businesses to continue to operate and succeed in new ways. Communications and social interactions evolved to incorporate online technology. In short, despite many obstacles, people figured out ways to do what they needed to do to survive and prosper. It was an imperfect approach and mistakes were made all along the way, and many hurdles are still ahead, but the human spirit has shown once again that it is a remarkable thing.

We will need to continue to persevere. The Coronavirus is apparently not done with us yet. The potential for future lockdowns will remain a threat to economic growth. Governments have borrowed a lot of money to provide stimulus to keep economies stable. Growth will come, we think, in spurts. The Dow and S&P 500 indices are currently hitting record highs. Bond values are being pushed down as yields are climbing higher. Investors are being more or less forced to invest in assets that have higher risk because ‘safe’ investments (like CDs, bonds and gold) offer little opportunity for a return on your investment.

The solution, we believe, is to take heart in the lessons learned from this past year. Don’t let short-term market reactions and expectations determine your asset allocation. Use a variety of assets to build an appropriately diversified portfolio. If you are in retirement or approaching retirement, bonds will play an increasing role in your allocation, even though bond prices are being pressured now. History shows us that bonds are less volatile than stocks. What might seem like a drag on portfolio performance today could be a saving grace in the future. Time horizon and risk tolerance are critical components in determining asset allocation. This is not a time to be greedy!

*The index returns are drawn from Morningstar Advisor Workstation. Indexes are unmanaged and cannot be invested in directly by investors. MSCI EAFE NR USD-This Europe, Australasia, and Far East index is a market-capitalization-weighted index of 21 non-U.S., industrialized country indexes. S&P 500 TR USD – A market capitalization-weighted index composed of the 500 most widely held stocks whose assets and/or revenues are based in the US; it’s often used as a proxy for the stock market. TR (Total Return) indexes include daily reinvestment of dividends. Bloomberg US Agg Bond TR USD This index is composed of the BarCap Government/Credit Index, the Mortgage Backed Securities Index, and the Asset-Backed Securities Index. The returns we publish for the index are total returns, which includes the daily reinvestment of dividends. The constituents displayed for this index are from the following proxy: iShares Core US Aggregate Bond ETF. MSCI Emerging Markets IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. Russell 2000 – Consists of the smallest 2000 companies in the Russell 3000 Index, representing approximately 7% of the Russell 3000 total market capitalization. The returns we publish for the index are total returns, which include reinvestment of dividends. The MSCI Emerging Markets (EM) IndexSM is a free float-adjusted market capitalization index that is designed to measure equity market performance in the global emerging markets. As of May 2005 the MSCI Emerging Markets Index consisted of the following 26 emerging market country indices: Argentina, Brazil, Chile, China, Colombia, Czech Republic, Egypt, Hungary, India, Indonesia, Israel, Jordan, Korea, Malaysia, Mexico, Morocco, Pakistan, Peru, Philippines, Poland, Russia, South Africa, Taiwan, Thailand, Turkey and Venezuela.. The FTSE NAREIT Equity REITs Index is an index of publicly traded REITs that own commercial property. All tax-qualifies REITs with common shares traded on the NYSE, AMSE or NASDAQ National Market List will be eligible. Additionally, each company must be valued at more than $100MM USD at the date of the annual review. Equity REITs include Diversified, Health Care, Self Storage, Industrial/Office, Residential, Retail, Lodging/Resorts and Specialty. They do not include Hybrid REITs, Mortgage Home Financing or Mortgage Commercial Financing REITs. Bloomberg Sub Gold TR USD Description unavailable. Formerly known as Dow Jones-UBS Gold Subindex (DJUBSGC), the index is a commodity group sub-index of the Bloomberg CI composed of futures contracts on Gold. It reflects the return of underlying commodity futures price movements only and is quoted in USD.